Table of Content

A pre-qualification will provide you with an estimate of how much money you’re eligible to borrow for a home and which loan options are best for you. If it’s time for you to look into a home renovation but you don’t have the cash in hand to pay out of pocket, you can use your home itself to make it happen. There are three popular ways to use the equity you’ve built in your home to finance a renovation project. When determining how much you need to borrow for your home renovation, make sure your factor in labor costs, inspection fees, permits, and architectural or engineering services. Have a clear picture of what changes you want to make to your home. Do your research and get a good idea of what it will cost.

You wake up one day and your bathroom feels cramped and outdated. You keep catching yourself daydreaming about all the ways you could make your home feel new again. You don’t want to sell your home, but you want to make some changes. One of the most important parts of buying a home is determining the kind of mortgage you need.

Caliber Home Loans Mortgage Interest Rate and Cost Review

There are plenty of loan options whether you want to buy a new home or refinance one you already own. A pre-approval is the best thing to have on-hand to prove your creditworthiness to a seller and lender. This requires a short application process and a credit check.

For homes that need some work, Caliber offers the Fannie Mae HomeStyle Renovation Loan, a type of conventional loan that could help you finance remodels, renovations, or repairs. With this loan, you might be able to borrow up to 75% of your home’s value after renovations. As a home buyer, you might already be familiar with the process of getting a mortgage. As a result of this extensive process, the mortgage lender will often take precautions to ensure that they can avoid too many losses.

Unique Loan Options

You can calculate your equity by subtracting how much you still owe on your mortgage from your home’s current market value. The higher your credit score and the greater the equity you have often make lower interest rates available to you. Use the Caliber Home Loans Loan Calculator to estimate your down payment amount, interest rate, and payment amounts. This will give you an idea of what to expect before you take out a home renovation loan. It is not unusual to be required to carry PMI if you made a down payment of less than 20%.

Consult with one of our licensed Mortgage Advisors to discuss the process and understand your best options. Caliber Home LoansCompare RatesIf you are looking for a lender with physical branch locations nearby, Caliber Home Loans may stand out to you more. Caliber Home Loans has branches in more locations across the US than Carrington Mortgage Services. You also can’t get a mortgage from Carrington if you live in Massachusetts or North Dakota. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades.

Regions Served by Caliber Home Loans

Securities and Exchange Commission as an investment adviser. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. Cons Caliber Home Loans doesn’t offer banking or investing services, meaning you can’t bundle your mortgage with other financial accounts you have.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™use advanced statistical techniques to forecast different rates based on a lender's historical data. I recently had a listing where the buyer used Caliber Home Loans.

Refinance Your Mortgage

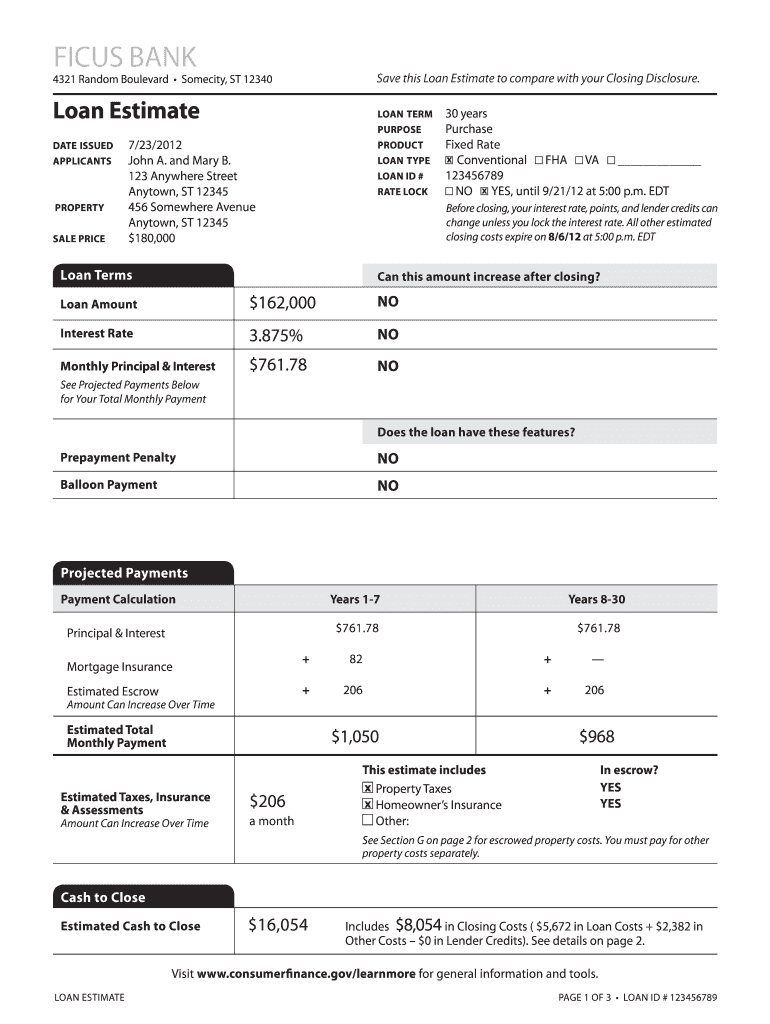

In our data, Caliber Home Loans originated Conforming, FHA, Jumbo, USDA and VA mortgages for new home purchases and refinances. Its average interest rate and total loan related closing cost difference relative to other lenders by mortgages type is as follows. As you can see, there is no single answer that works for every first-time homebuyer. The type of loan you're applying for, the cost of the home, and your credit score will determine the minimum amount required.

We may receive compensation from the products and services mentioned in this story, but the opinions are the author's own. We have not included all available products or offers. Learn more about how we make money and our editorial policies. This suite of home financing solutions seems to be even more aggressive, offering home loans with no seasoning requirement after bankruptcy, short sale, deed-in-lieu, or foreclosure. Seem to fall in line with the national average, though its rates are higher than some competitors.

Originates mortgages in all 50 states and Washington, D.C. Though you can’t rate shop online, you can stop in at one of its branches in 46 states or call for a rate quote. Refinancing might help you pay down your loan faster and save on interest. Understand the differences between a HELOC and a cash-out refinance. We’ll find you a highly rated lender in just a few minutes.

The company promises innovative technology, expert loan consultants and a loan processing period as short as 10 days. With services available in all 50 states, Caliber Home Loans has products for all types of buyers. Conventional loans generally come with closing costs and other lender fees, which may total 2-7% of the purchase price.

No comments:

Post a Comment